For organizations that have both volunteers and employees, it seems like a lot of material and tasks might intertwine. And while most of us know the basic difference between employees and volunteers is that employees get paid and volunteers don’t, there are some topics where the line feels blurred.

However, blurring the line between volunteers and employees can be a dangerous act for your organization as a whole. As JJ Communique states, “blurring the distinction between your volunteers and employees may inadvertently subject you to liability for wages, overtime and back-taxes under the Fair Labor Standards Act (FLSA).”

The Fair Labor Standards Act is one that every organization should make sure they are following. It is the number one Act that holds up in legal court, along with your state’s department of labor.

Let’s discuss some real concerns from our facebook group - The Real Lives of Volunteer Coordinators, and the legality behind certain actions and types of volunteers vs employees.

Volunteer Handbook Vs Employee Handbook & Volunteer “Job Descriptions”

In the first case of volunteer vs employee- it might seem like it won’t matter if you use the same handbook for volunteers that you do for employees. A volunteer handbook is a great way to onboard volunteers, and teach them about your organization, but one of the number one rules of the Fair Labor Standards Act is that a volunteer does not do the exact work of employees.

From Nonprofit Risk: “ Remember the Volunteer Service Rule of Three — “True” volunteers are those who: (1) work toward public service, religious, or humanitarian objectives; (2) do not expect or receive compensation for services; and (3) do not displace any genuine employees.”

So, while parts of a volunteer handbook might mimic parts of an employee handbook, they should not be the exact same, as volunteers should not be having the exact same roles or tasks as genuine employees.

Tip for distinguishing between volunteers and employees: Write everything out for each party, including handbooks, role descriptions, agreement forms, confidentiality statements, etc. If ever questioned legally, it will be important to separate and showcase these documents.

But, just because volunteers do not have the same experiences as employees and maybe not as many crucial tasks as employees do, does not mean that volunteers aren’t allowed to do important or confidential work. So it is essential that a volunteer handbook or some sort of written verbiage showcases the rights and responsibilities of volunteers vs employees.

Rocket Lawyers says, “Volunteers do not have the rights of employees or workers. However, the organization using volunteers should make sure they have relevant health and safety procedures and data protection policies in place.”

Volunteers Covered Under Workers Comp Like Employees

This one is tricky, and each organization should check with their state Department of Labor before making the final call.

While volunteers should have relevant safety and health measures put in place by the organization, it is a bit tricky if volunteers are able to be covered under the same workers’ compensation fund that employees are.

If your state does include workers’ compensation as something that volunteers are allowed to receive, then you must follow these regulations and guidelines from the FLSA & IRS.

“In general, a nonprofit employer must treat payments to volunteers the same as payments to employees, which means that income tax and FICA contributions must be withheld. (See 26 U.S.C. § 3402). Living allowances, stipends and in-kind benefits should generally be treated like wages.”

Tip for circumstances to deal with liability money towards volunteers versus employees: Talk to a representative from the Department of Labor from your organization’s state to get the final say on what is and is now allowed.

How To Determine If Workers Should Be Classed As Volunteers or Employees

The two definitions should help distinguish between a volunteer or an employee. Beyond payment, volunteers don’t necessarily work for an employer, more for a mission or public service. In addition, if a volunteer is not present, it should not reflect the day-to-day workflow of an organization or employers.

Definition of Employee:

“An employee is a worker who performs services for the employer, and the employer controls how and what the employee will do. The Fair Labor Standards Act (FLSA) defines the term "employ" to include "to suffer or permit to work" for an employer.” - SHRM Foundation

Definition of Volunteer:

“A volunteer donates his or her time and energy without receiving a financial or material gain. The individual would need to a) work toward public service, religious or humanitarian objectives; b) not expect or receive compensation for services; c) not displace any genuine employees. Under FLSA regulations, an individual cannot volunteer services to a private, for-profit company.” - SHRM Foundation

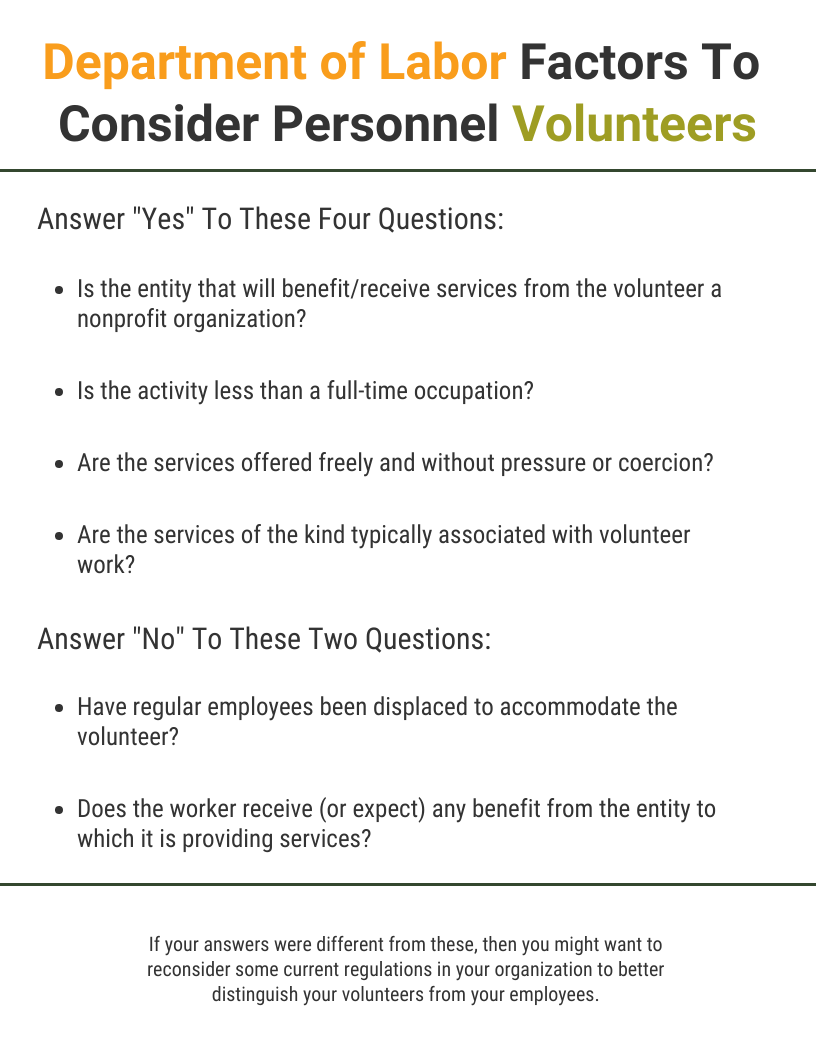

Nonprofit Risk also evaluates the Department of Labor’s six factor questionnaire to determine volunteers vs employees.

A great starting point to distinguish volunteers vs employees more in your organization is to start tracking volunteer time independently of employee activities and tasks.

This can be made possible by having an easy volunteer time tracking system like Track It Forward. This allows volunteers’ time, activities, and events to be tracked per volunteer and per program category. Reports can easily be pulled instantly for a variety of metrics including the number of volunteers, the number of hours volunteered per week, and so on.

It is important that you strictly outline volunteers vs employees to legally back up your organization if it comes to any dispute or malpractice with treatment of volunteers or employees!

Written by

Written by